Safeguard Your Home and Loved Ones With Affordable Home Insurance Policy Program

Significance of Affordable Home Insurance Coverage

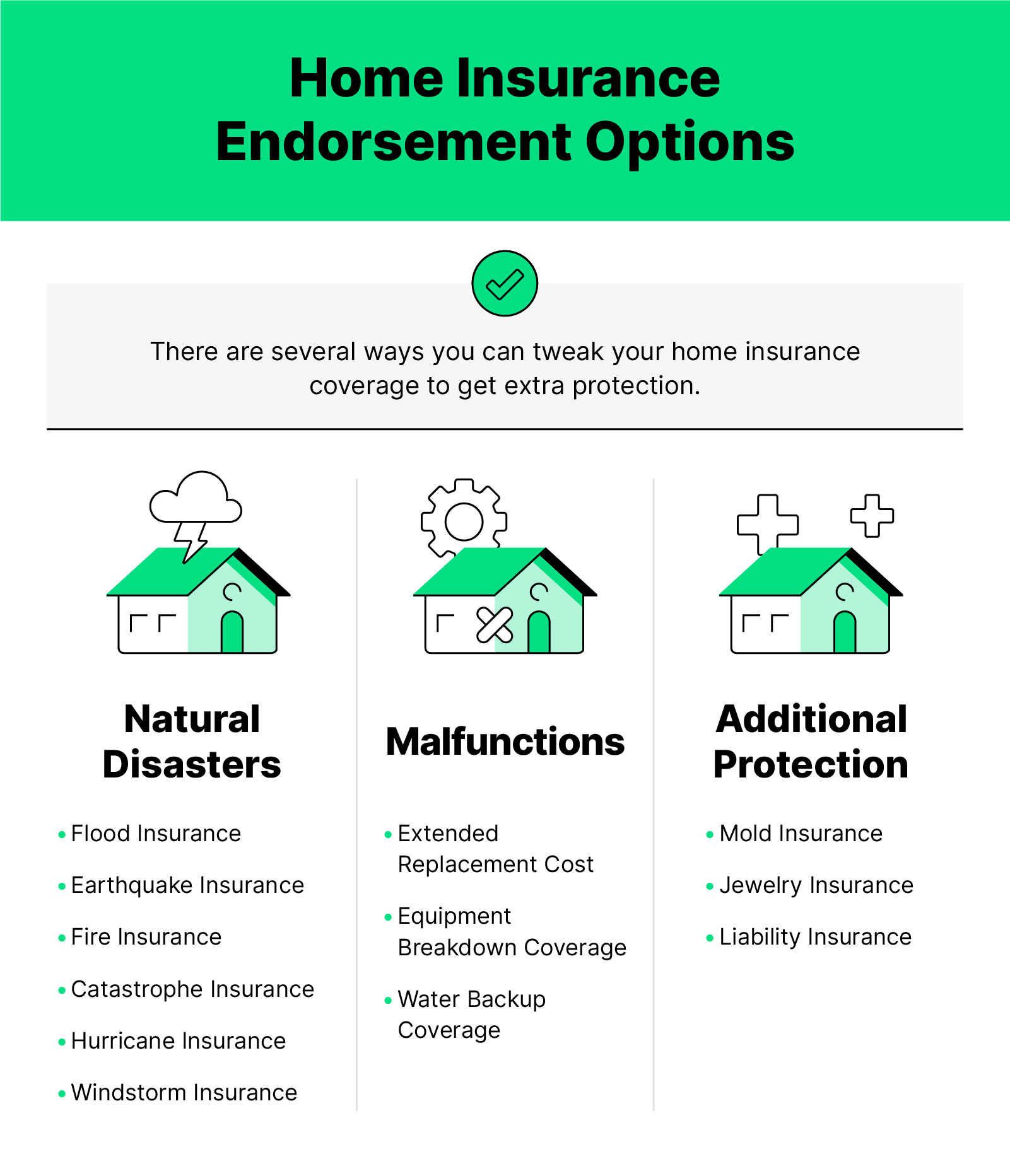

Securing budget friendly home insurance is important for protecting one's home and financial well-being. Home insurance coverage provides security against different dangers such as fire, theft, natural disasters, and individual responsibility. By having a detailed insurance plan in area, homeowners can feel confident that their most significant investment is protected in the occasion of unexpected situations.

Budget friendly home insurance coverage not only gives financial safety and security but additionally offers satisfaction (San Diego Home Insurance). Despite climbing property values and construction prices, having a cost-efficient insurance coverage ensures that homeowners can easily reconstruct or repair their homes without dealing with considerable monetary concerns

In addition, inexpensive home insurance can also cover personal valuables within the home, offering compensation for products harmed or swiped. This insurance coverage expands beyond the physical structure of your home, shielding the materials that make a residence a home.

Coverage Options and Limits

When it comes to insurance coverage restrictions, it's essential to recognize the maximum amount your plan will pay for every kind of insurance coverage. These limits can differ depending upon the plan and insurance firm, so it's necessary to assess them very carefully to ensure you have sufficient security for your home and possessions. By comprehending the insurance coverage options and limits of your home insurance plan, you can make enlightened decisions to guard your home and liked ones properly.

Aspects Affecting Insurance Coverage Prices

A number of variables significantly affect the expenses of home insurance plan. The place of your home plays a vital role in figuring out the insurance policy premium. Residences in areas vulnerable to natural calamities or with high criminal activity prices commonly have higher insurance policy costs as a result of boosted risks. The age and problem of your home are also aspects that insurance firms consider. Older homes or residential or commercial properties in inadequate problem might be much more pricey to guarantee as they are more susceptible to damages.

Moreover, the kind of protection you choose straight impacts the expense of your insurance plan. Going with extra insurance coverage choices such as flood insurance or quake insurance coverage will increase your costs. In a similar way, selecting greater coverage limits will cause higher prices. Your insurance deductible amount can likewise influence your insurance policy expenses. A higher deductible usually implies reduced costs, but you will need to pay even more expense in the event of a case.

Additionally, your credit rating, claims history, and the insurer you choose can all influence the price of your home insurance policy. By taking into consideration these aspects, you can make informed choices to assist handle your insurance costs effectively.

Comparing Providers and quotes

In enhancement to contrasting quotes, it is important to review the online reputation and monetary stability of the insurance policy carriers. Try to find consumer testimonials, rankings from independent companies, and any background of issues or regulatory activities. A trustworthy insurance provider ought to have a great track record of promptly refining claims and providing exceptional customer support.

Furthermore, consider the certain protection features provided by each service provider. Some insurance firms may provide fringe benefits such as identification theft security, devices failure insurance coverage, or insurance coverage for high-value things. By meticulously contrasting quotes and service providers, you can More about the author make an informed decision and pick the home insurance policy plan that best satisfies your needs.

Tips for Reducing Home Insurance Policy

After extensively contrasting providers and quotes to discover one of the most ideal coverage for your demands and budget plan, it is sensible to discover reliable approaches for saving on home insurance coverage. Among the most significant methods to save money on home insurance is by packing your plans. Several insurer use discount rates if you purchase numerous policies from them, such as integrating your home and car insurance policy. Enhancing your home's safety and security steps can additionally bring about savings. Mounting safety and security systems, smoke alarm, deadbolts, or a sprinkler system can reduce the risk of damage or burglary, blog possibly reducing your insurance policy costs. Furthermore, maintaining a great credit history rating can favorably influence your home insurance coverage rates. Insurers usually consider credit report when determining costs, so paying costs on time and managing your credit properly can lead to reduced insurance costs. Finally, consistently assessing and upgrading your plan to mirror any changes in your home or circumstances can ensure you are not paying for coverage you no longer demand, assisting you save money on your home insurance coverage costs.

Final Thought

Finally, guarding your home and enjoyed ones with economical home insurance coverage is vital. Recognizing protection alternatives, aspects, and limits influencing insurance costs can assist you look at this website make informed choices. By comparing quotes and providers, you can discover the most effective policy that fits your needs and budget plan. Executing ideas for reducing home insurance coverage can also help you safeguard the needed defense for your home without breaking the financial institution.

By untangling the intricacies of home insurance coverage plans and discovering sensible approaches for securing economical protection, you can ensure that your home and loved ones are well-protected.

Home insurance coverage policies typically supply several coverage choices to protect your home and possessions - San Diego Home Insurance. By recognizing the coverage options and limits of your home insurance coverage policy, you can make enlightened decisions to guard your home and loved ones properly

Routinely reviewing and upgrading your plan to reflect any kind of modifications in your home or situations can guarantee you are not paying for protection you no longer requirement, aiding you save cash on your home insurance coverage costs.

In conclusion, protecting your home and liked ones with inexpensive home insurance coverage is critical.